When your business crosses the $1 million mark in revenue, every financial decision matters more than ever. And one area that often flies under the radar until problems arise is accounting.

So how much should you really be spending on accounting support?

Whether you’re scaling up, maintaining steady growth, or tightening margins, understanding the true cost and value of accounting services is critical.

In this article, we break down typical accounting spend for businesses, compare in-house and outsourced options, and help you assess whether your current business accounting setup is still serving you.

At a Glance

- Accounting spend isn’t one-size-fits-all. It flexes based on business size, complexity, and the level of support you need.

- Typical costs scale with growth. This can range anywhere between $2K-$6K per month for $1M-$5M businesses, up to $150K+ annually for mature $15M+ companies.

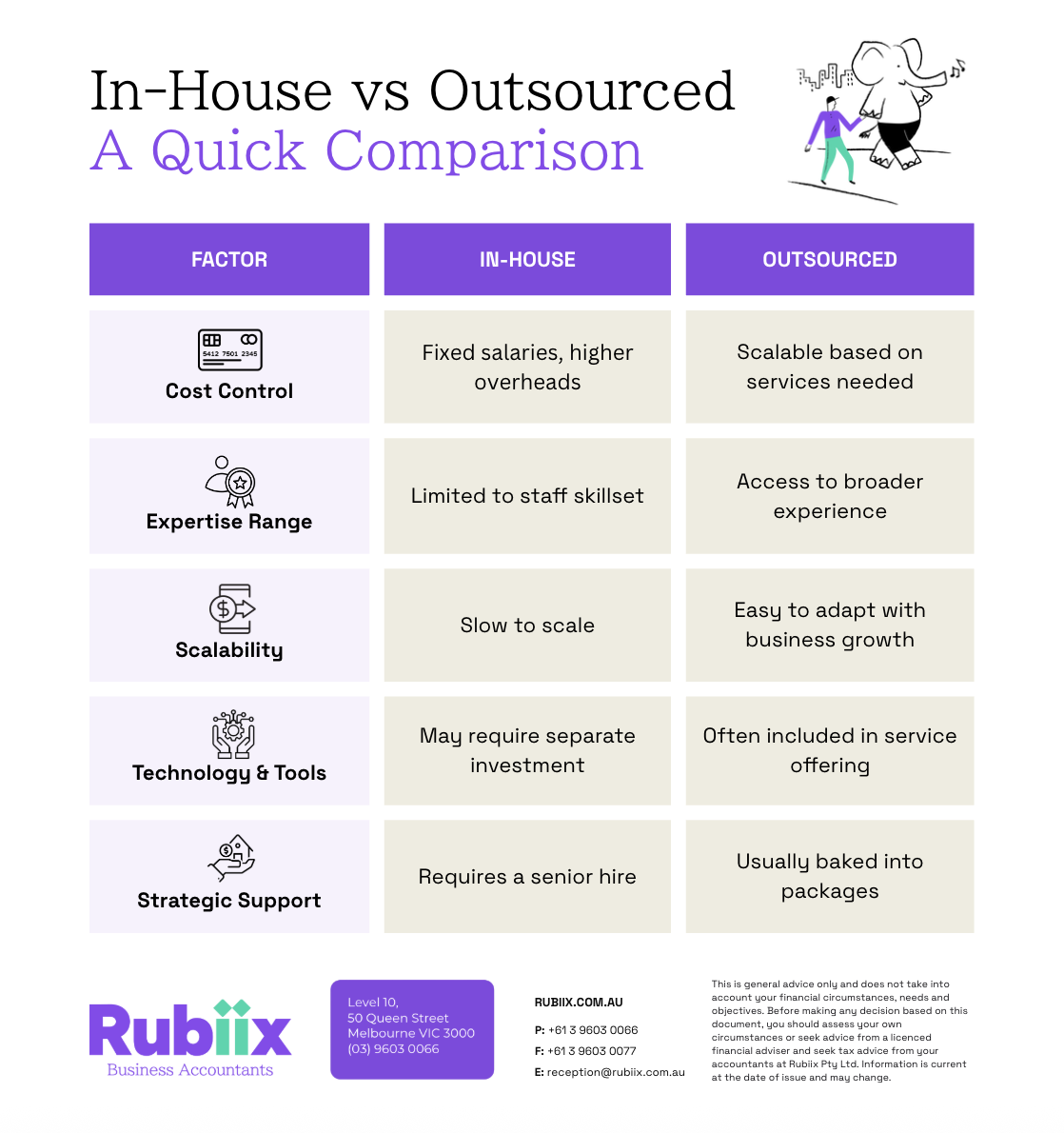

- In-house vs outsourced matters. Outsourcing offers flexibility and broader expertise, while in-house teams bring stability but higher overheads.

- Your setup needs regular review. If reports are late, ATO issues arise, or advice is only backwards-looking, it’s time to reassess.

Why Accounting Costs Vary So Much

No two businesses spend the same on accounting. A startup hitting its first million in turnover has very different needs than a $20M operation juggling multiple entities, dozens of staff, and cross-border tax issues.

That’s why “average costs” can be misleading.

What really drives your accounting spend comes down to five main levers:

- Business size and revenue: Bigger numbers mean bigger responsibilities. As transaction volume and staff numbers rise, so do compliance and reporting demands.

- Complexity of operations: A single-entity retail store is simpler to manage than a group of companies spanning trusts, subsidiaries, or international trade. Complexity adds hours — and cost.

- Level of service required: Do you just want BAS and payroll ticked off, or do you need strategic advisory, tax structuring, and CFO-style insights? The depth of support is a key cost driver.

- In-house vs outsourced model: Hiring staff locks you into fixed salaries and overheads, while outsourcing gives you scalability but at a monthly service rate. Hybrid setups land somewhere in the middle.

- Technology and systems: If you’re still on clunky spreadsheets, accountants will spend more time (and bill more hours). Modern cloud platforms can streamline processes and lower costs.

The point is, accounting costs aren’t random. They flex around your business model, stage of growth, and appetite for forward-looking advice.

1. Small to Medium Business ($1M-$5M Revenue)

At this stage, many businesses outgrow basic bookkeeping, but might not be ready to build an in-house finance team.

Typical Accounting Spend:

- Outsourced Support: $2,000 to $6,000 per month

- In-House Hire (1 FTE): $70,000 to $100,000+ annually, excluding super and overheads

Common Services Needed:

- Monthly reconciliation

- BAS and GST lodgements

- Payroll and superannuation

- Financial statements and reporting

- Strategic tax planning

What to Consider:

Outsourcing at this stage often offers better value and flexibility. You get access to a team of specialists without the cost burden of full-time salaries.

2. Growing and Scaling Businesses ($5M–$15M Revenue)

Your accounting needs become more complex. You may be considering or already have part of an in-house team, but strategic oversight and compliance are still critical.

Typical Accounting Spend:

- Hybrid Model: $4,000 to $12,000 per month

- Partial In-House Team + External Advisors

Common Services Needed:

- CFO-level advisory

- Cash flow forecasting

- Budgeting and modelling

- Industry-specific tax structuring

- Real-time dashboard reporting

What to Consider:

At this growth stage, having a dedicated advisory accountant who understands your industry and goals can make a significant difference. A hybrid model allows you to scale financial or business strategy with minimal risk.

3. Mature Business ($15+ Revenue)

With scale comes complexity. Internal teams usually handle day-to-day accounting, but external experts are often brought in for audit readiness, compliance, tax planning, and strategic advisory.

Typical Accounting Spend:

- Combination of In-House and External Support: $150,000+ per year

- Specialist Consultants as needed

What to Consider:

Efficiency matters here. Internal costs can escalate without the right systems and checks.

Outsourced advisors can provide a fresh perspective and ensure compliance in a changing regulatory environment.

Is Your Current Accounting Setup Fit for Purpose?

It’s easy to stick with the same accountant or internal system simply because it feels familiar.

But businesses rarely stay the same.

Revenue grows, structures change, new staff join, and operations expand into different markets. What worked two years ago may now be holding you back, or worse, putting you at risk of mistakes and missed opportunities.

Some red flags that signal it’s time for a review:

- Late or inaccurate reporting: If you’re waiting weeks for numbers or spotting errors in the data, you can’t make confident decisions.

- ATO or compliance issues: Whether it’s missed lodgements, incorrect BAS submissions, or penalties, trouble with the Australian Tax Office is a clear sign your accounting setup isn’t keeping pace.

- No forward-looking advice: If you’re only hearing about what already happened, you’re missing the strategic insights that help you plan ahead.

- Lack of cash flow clarity: Not understanding where the money is going (or when it’s arriving) makes growth planning almost impossible.

- Business model mismatch: Adding new revenue streams, entering new markets, or shifting to a more complex structure means your accounting approach needs to evolve too.

A healthy accounting function should give you more than compliance. It should deliver timely, accurate insights that help you see risks before they bite and spot opportunities before competitors do. If your setup isn’t providing that, it’s time to reassess.

Frequently Asked Questions

How can I tell if I’m overpaying for accounting?

You may be overpaying if costs keep rising without added value, if you’re billed for basic tasks that could be automated, or if you’re not receiving insights that support growth.

Benchmarking your fees against businesses of similar size can highlight gaps.

What’s the ROI of better accounting support?

Strong accounting support delivers more than compliance. It helps you improve margins, avoid ATO penalties, reduce wasted spend, and make faster decisions. For many $1M+ businesses, the ROI shows up in cash flow stability and growth opportunities uncovered through better reporting.

How often should I meet with my accountant?

Growing businesses should meet at least quarterly for forward-looking strategy and tax planning, not just year-end compliance.

Larger or fast-moving companies benefit from monthly reviews to stay on top of cash flow, KPIs, and growth targets.

What technology should my accountant be using?

Cloud platforms like Xero, MYOB, or QuickBooks Online are now standard. If your accountant still relies on manual spreadsheets, you may be paying for inefficiencies.

Real-time dashboards and integrated payroll systems are a sign of a modern setup.

Can accounting support scale as my business grows?

Yes. Most businesses start with outsourced support, then layer on in-house roles or CFO-level advisory as they expand. The key is choosing an accountant who can scale their service to match your growth, rather than forcing you to switch providers.

Final Thoughts

Accounting is more than just a cost – it's a value driver. When managed well, it gives you clarity, compliance, and confidence in your decisions. For $1M+ businesses, accounting support should empower growth, not just reconcile the past.

At Rubiix Business Accountants, we help businesses align their accounting support with where they are and where they’re going.

Whether you’re reviewing your current provider or considering outsourcing for the first time, our team is here to offer clarity and a fresh perspective.

Book a confidential appointment with Rubiix to assess your accounting setup and explore a smarter way to scale.

Join the conversation on LinkedIn

Connect with us on LinkedIn to get updates, insights, and resources tailored for growing Australian businesses.

Disclaimer: The information in this article is general in nature and does not constitute legal or medical advice. Please consult a qualified adviser for personalised guidance.